Verlängerung der Bewerbungsfrist

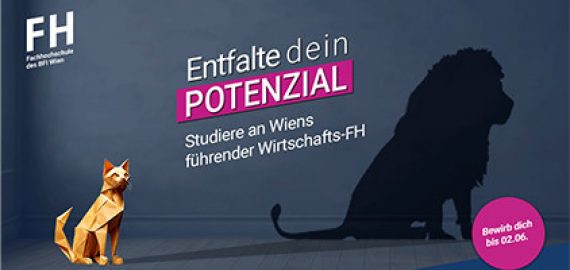

Gute Nachrichten für alle Studieninteressierten: Wir haben unsere Bewerbungsfristen verlängert! Du hast jetzt noch bis zum 02. Juni die Chance, dich für dein Wunschstudium bei uns zu bewerben.

Mehr Infos

Unser Lernservices Angebot

Ob die Einführung in die Bibliothek, Tipps zur Literaturrecherche oder die passende Lerntechnik. Schauen Sie sich unser Angebot an Lernservices an.

Mehr Infos

Studieren ohne Matura

Sie möchten Sich beruflich umorientieren oder weiterentwickeln? Wir erklären Ihnen wie Sie auch ohne Matura an der FH des BFI Wien Ihr Bachelor-Studium beginnen können.

2 Frauen mit Laptop

2 Frauen mit Laptop

Mehr Infos

Veranstaltungen

05.Juni 2024 09:00-16:30 UHR

PM Symposium "Denken oder denken lassen? KI im Projektmanagement"

Festsaal

22.Mai 2024 17:00-18:00 UHR

Online-Infosession: Technical Sales and Marketing

online

27.Mai 2024 19:00-20:00 UHR

Online-Infosession: Projektmanagement und Organisation

online

Zahlen & Fakten

6404

Student:innen

9442

Absolvent:innen

27

Studien- und Hochschullehrgänge

610

Lektor:innen

80

Partnerhochschulen

305

Unternehmenspartner:innen